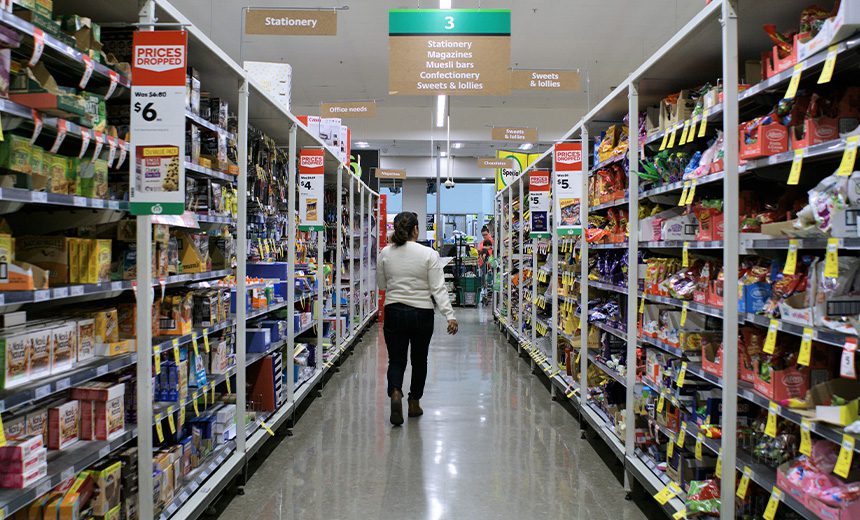

From small roadside stalls to supermarkets and delivery apps, the way people buy everyday items is shifting, and it’s affecting businesses of all sizes. To stay ahead, brands need real, up-to-date insights about how people shop and what they value.

Ghana’s retail market has grown in recent years. Modern stores and e-commerce platforms are becoming more popular, especially in cities. But even with this growth, over 60% of daily purchases still happen in open markets, small shops, and informal stalls. This mix of traditional and modern shopping means businesses need to understand both digital trends and how people shop in their local communities.

The fast-moving consumer goods (FMCG) sector is a good example. Products like drinks, snacks, and toiletries are still in high demand, but how people buy them is changing. In 2024, FMCG volumes in Ghana grew by about 4%, even with rising prices. Shoppers are adjusting, choosing mid-sized packs for better value and switching between traditional shops and formal retail stores based on price and convenience.

For companies in the retail space, this means they need to listen closely to what consumers want and adjust their products, prices, and delivery methods to match. Real insights from the ground are now more important than ever.

That’s where local research firms like SumsureIQ come in. Known for its focus on retail fieldwork, SumsureIQ tracks over 70 FMCG categories across Ghana’s 16 regions. Each month, they collect thousands of data points from open markets, small shops, supermarkets, and distributors. Their performance tracking reports help brands spot trends early, whether it’s a drop in sales volumes or the sudden rise of a new product category.

In Ghana, success depends on knowing what people are buying, where, and why. Field data captures local realities that desktop research can’t. It helps FMCG brands adjust pack sizes, plan promotions, and manage stock more effectively.

Ghana’s retail landscape isn’t about digital vs. traditional; it’s both. And as competition grows, brands that invest in ground-level insights will shape the future of retail in Ghana and West Africa.