In most parts of Africa, many people cannot afford mobile data or buy newer smartphones. According to a 2025 World Bank report, residents in many countries still spend nearly 2.4% of their income just for 1 GB of mobile data. That puts mobile internet out of reach for many. Because of this, millions rely on feature phones or phones with limited internet access.

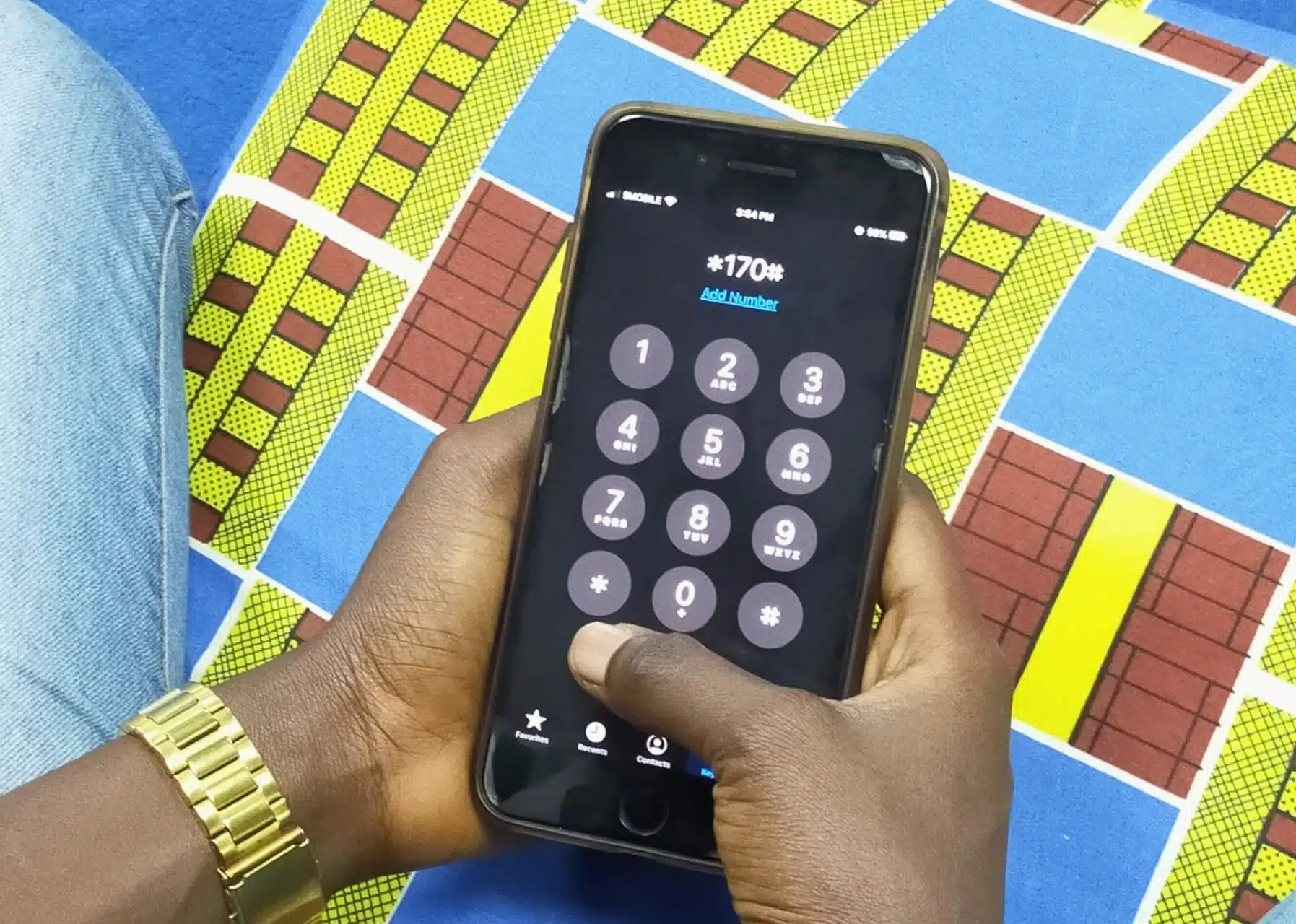

USSD (Unstructured Supplementary Service Data) works without internet or even a smartphone. It uses simple text-based codes (like dialling *123#) to show menus and perform basic transactions. With USSD, people can check balances, send money, top up airtime, and even order basic services, without worrying about data or expensive phones.

Because USSD works under basic network conditions and on any GSM phone, it remains a lifeline. Even when data is spotty or when a user is in a rural area with weak signals, USSD often still works. That reliability builds trust. Users know that even when their internet is down or their phone is old, they can still use vital services.

In Nigeria in 2024, USSD transaction volume reached N2.19 trillion over more than 252 million transactions in just six months. That shows people are still using USSD heavily for peer-to-peer transfers, bill payments, and other routine financial tasks.

Telecom providers are also changing how USSD charges work. Also in Nigeria, a recent policy was introduced where USSD charges are taken from airtime rather than separate billing methods. This shift makes costs more transparent. Users can see how much they are using and paying. They feel less surprised. That builds confidence and lowers the psychological cost of using USSD.

In other countries, telcos and fintechs are testing shorter USSD session times, simpler menu flows, and fewer steps. All of these changes reduce drop-off. When USSD sessions take too long, users abandon them. When menus are confusing, they get lost. Simplifying the flow helps people complete transactions more reliably.

If a brand assumes everyone has a modern smartphone and steady internet, it risks missing many potential users. These are often the people who could drive growth if approached with inclusive tools. For example, a rural seller, a small farmer, or someone in a peri-urban area may not buy your product because your app fails or loads slowly or doesn’t open at all without data.

But companies that embrace USSD alongside apps can reach those users. Imagine a utility provider that allows bill payments via USSD and via app. If someone can’t load the app, they use USSD. Once internet access becomes easier, they might switch. The key is not forcing everyone into one channel.

Also, reliability matters. If your USSD flow works consistently, people will trust your brand. One failed transaction due to an app or network error drives negative word-of-mouth. USSD builds reliability in less-than-perfect conditions.

Brands that build USSD as a core part of their digital delivery will gain more customers now. They will reach people who have been excluded by high data costs and a lack of internet. These are often new markets with less competition, making them valuable. Offering USSD alongside apps also builds brand loyalty. When people see that your service works reliably even in difficult conditions, they trust you more. That trust leads to more usage, more referrals, and a better reputation.

FREE INSIGHTS REPORT