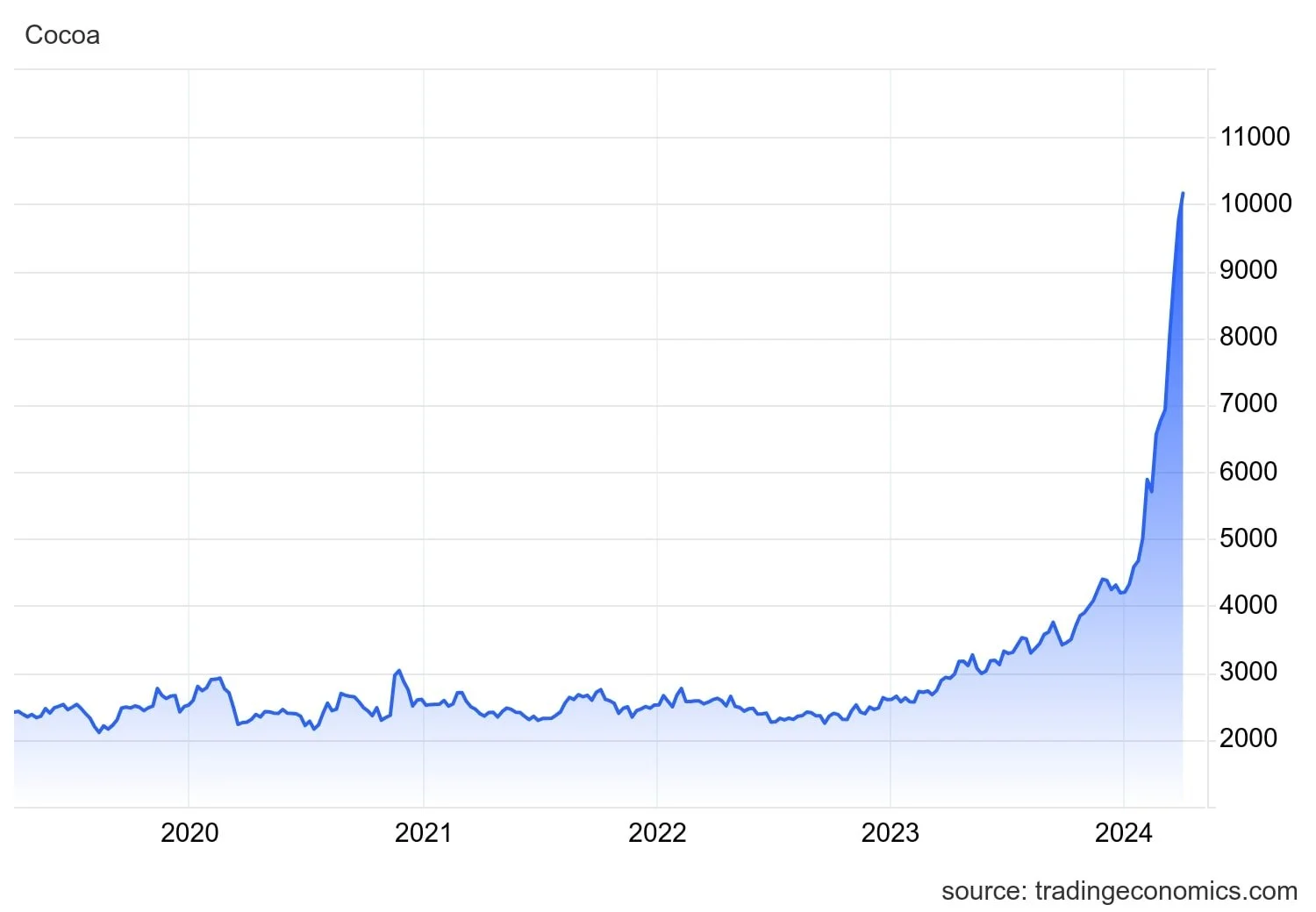

After soaring to historic highs of over $12,000 per tonne in late 2024, cocoa prices are now sharply declining, falling below $8,000 per tonne and leading losses across agricultural markets in 2025. The question is why the downturn is happening and what it means for producers, consumers, and the chocolate industry at large.

The immediate driver is weaker demand. Cocoa grindings, a key measure of industrial use, have dropped significantly: -7.2% year-on-year in Europe, -16% in Asia, and -2.8% in North America. Manufacturers have struggled with high costs and shrinking margins, leaving less room to absorb elevated cocoa prices. For consumers, this has already translated into more expensive chocolate, reduced sales volumes, and shifting consumption patterns, with private labels gaining ground among price-sensitive buyers while premium products still attract niche demand.

On the supply side, conditions are starting to improve. Weather patterns in West Africa, the world’s largest cocoa-producing region, are showing signs of recovery, with rainfall expected to boost crop yields in the 2025/26 season. Ecuador is also bringing new plantings to maturity, further increasing global supply. These developments could push prices lower in the short term, although analysts at J.P. Morgan expect cocoa to remain structurally high, forecasting a medium-term average of around $6,000 per tonne.

For the global chocolate industry, the implications are mixed. While falling prices may offer some relief to manufacturers, higher structural costs mean consumer prices are unlikely to drop significantly in the near term. Instead, companies may continue to pass on costs, potentially keeping demand subdued even as supply improves.

The cocoa price cycle underscores a deeper challenge for the sector: balancing supply resilience with demand realities in a market shaped by climate shifts, production constraints, and consumer price sensitivity. The current decline may bring temporary breathing space, but structural volatility is likely here to stay.