According to the global narrative, Africa and the Middle East combined contribute only 3% of the $142 billion market research industry. However, we believe that number is a gross misrepresentation and very far from the real picture. From rising digital markets to underreported agency activity, Africa’s insights sector is operating far beyond what global trackers show. The continent’s contribution may realistically sit closer to 15%, with a plausible upside of 15%, which is five times higher than the industry’s current estimate. How, then, does this gap exist?

The 3% figure from ESOMAR’s 2023 Global Market Research report combines Africa and the Middle East, positioning them as minimal in global insight activity. However, much of Africa’s market research occurs outside formal tracking channels. Many local agencies do not report data to global organisations like ESOMAR or WARC; even though regional bodies such as the Nigerian Marketing Research Association (NIMRA), the African Market Research Association (AMRA), and the Southern African Marketing Research Association (SAMRA) actively promote industry standards and professional networking. While these associations foster collaboration and training, they do not yet maintain continent-wide, standardised revenue reporting that feeds into global datasets. As a result, significant volumes of Africa’s insight work, especially from informal or localised projects in sectors like government, agriculture, digital commerce, and media, remain invisible in international statistics.

Another factor skewing the numbers is subcontracting invisibility. Many global projects that involve African fieldwork are commissioned by multinational research firms headquartered in Europe or North America. While the work is executed locally, sometimes with full research design and analysis by African teams, the revenue is booked in the commissioning country. This means millions of dollars in Africa-generated research turnover are effectively counted in the GDP of London, New York, or Paris, rather than Lagos, Nairobi, or Johannesburg.

According to Global statistics, Africa alone accounts for about $2.6 trillion out of a $110 trillion global economy, and then the Middle East contributes another 5%. With this, if market research spending aligns according to GDP, Africa and the Middle East should hold at least 7-8% of the global market research economy, but even GDP doesn’t cover everything. The increase in mobile connectivity, digital commerce and financial inclusion has created new data needs across multiple sectors, from fintech in Nigeria to consumer goods in Kenya.

Africa’s digital transformation market is expected to grow from $23 billion in 2024 to $45 billion by 2029. Additionally, advertising spending on the continent is projected to surpass $10 billion by 2025. These sectors depend heavily on market intelligence, brand perception studies, audience segmentation, and campaign effectiveness research. Agencies within this ecosystem generate insights daily, yet their revenues remain largely unreported in global research indices. Thus, Africa’s share in global market research may be closer to 8–12%, potentially reaching up to 15% when considering untracked work from small and midsized firms.

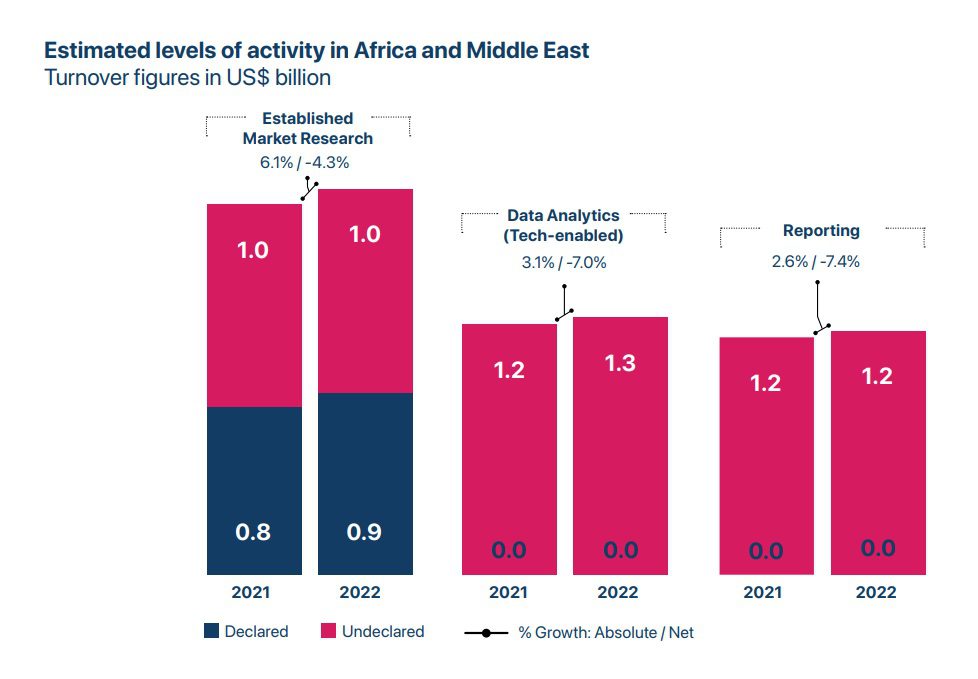

Compounding this is the sector’s transparency challenge. Some agencies deliberately keep their numbers private to avoid competitive exposure or tax-related scrutiny, while others lack the internal financial categorisation to separate “research” turnover from adjacent consulting or marketing services. Additionally, ESOMAR’s traditional reporting framework tends to focus on “established” methodologies, meaning entire revenue streams from tech-enabled insights, UX testing, e-commerce analytics, and influencer marketing measurement often go uncounted.

Africa’s insights industry is not only underreported but also underutilised. As local businesses grow and multinationals adjust their strategies for African markets, the demand for precise, localised data becomes essential. Dependence on outdated or insufficient global data results in misguided decisions and lost opportunities. A more comprehensive understanding of Africa’s market research landscape could draw more investment, promote data-driven policymaking, and enhance the continent’s influence in shaping global consumer trends.

If industry bodies broadened their definition of “insights” to capture emerging digital research formats and incentivised more African firms to report, the official share would likely double overnight. The key is building trust, reducing reporting friction, and ensuring that African agencies see value in contributing data, not just to global trackers, but to an Africa-led benchmarking system that reflects the continent’s real activity.

Africa’s insights industry is bigger than the numbers say, and it’s consistently scaling. Recognising and measuring this growth accurately isn’t just a matter of pride; it’s essential for smarter strategy, better outcomes, and sustainable economic development. It’s time to start sharing our data in the international space to leave our mark and showcase our full value in the global market research economy.